Need fresh thinking? Help is a few keystrokes away.

We Know Which Patient Groups Care Most About Alternative Medicine

All patients are not created equal. Some prefer traditional approaches to medicine, while others prefer alternative approaches. And how can you target them? They don’t fit into a neat package of age, gender, income, etc.

LAVIDGE conducted a national consumer healthcare study in early 2020, with an amended survey in May 2020. The objective was to learn attitudes of healthcare consumers and define segments that share those attitudes—pre-pandemic and during the 2020 COVID-19 crisis.

The study uncovered four key healthcare consumer segments:

- Team Players - like and trust their doctors and are confident in the healthcare system.

- Bystanders - are intimated by the healthcare system and health are providers.

- Crusaders - feel that everyone should have equal access to quality healthcare.

- Boss - conducts their own healthcare research and challenges their doctors.

This is the sixth in a series of articles in which we reveal several “Light-Bulb Moments” our research uncovered.

Light-Bulb Moment 6: Interest in alternative medicine varies substantially

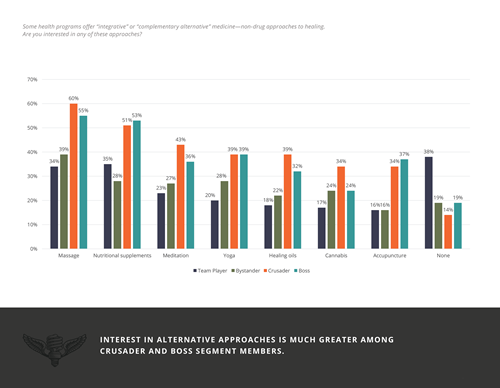

While it’s certainly true that interest in alternative medicine exists among all segments, it is much greater among Crusader and Boss members.

Leave it to the Crusaders to pull in the top—and the bottom—levels of interest in various categories of alternative medicine. At 14%, they were least likely to say they had no interest at all. And at 60%, Crusader members who say they are interested in massage turned out to be the highest level from any segment in any single alternative therapy. Boss members were right behind them.

Leave it to the Crusaders to pull in the top—and the bottom—levels of interest in various categories of alternative medicine. At 14%, they were least likely to say they had no interest at all. And at 60%, Crusader members who say they are interested in massage turned out to be the highest level from any segment in any single alternative therapy. Boss members were right behind them.

Of Team Player and Bystander members, for example, 34% and 39% respectively say they are interested in massage as an alternative approach to healing what ails them. In contrast, 60% of Crusader and 55% of Boss segment members expressed interest in massage as an alternative approach to healthcare.

Outliers include cannabis and an absence of interest in alternative approaches

While Crusader segment members at 34% maintained the highest percentage of respondents who say they are interested in the cannabis category of alternative medicine, Bystander and Boss segment members tied at 24% for the second-highest level of interest. Team Player segment members pulled up the rear with only 17% of them saying they have a positive attitudes regarding the use of cannabis, sometimes referred to simply as medical marijuana, as an alternative approach for personal health.

Consistent with their dismissal of cannabis, 38% of Team Players reported having no interest in alternative approaches to medicine. Bystanders and Boss group members who say they have no interest tied at 19% each, with Crusaders at only 14% being least likely to dismiss integrative options.

Patient beliefs among segments remained consistent across all demographics

We also found that patient beliefs about alternative medicine did not fall neatly into demographic groups such as age or gender. Instead, they were consistent across all demographics.

This suggests that healthcare decisions are tied to their beliefs and attitudes, not their age, gender or other demographic classification.

Clearly, there is no substitute for attitudinal segmentation when it comes to healthcare marketing research.

Partner with our experienced healthcare marketing agency

Chances are, you now see the value in switching from demographic research to attitudinal research for your upcoming marketing projects.

Going it alone, especially in a post-pandemic market, can be risky for medical practices in 2020 and beyond. More than ever, choosing the best agency to partner with for consumer healthcare marketing messages has never been more important.

Consumer attitudes are changing, and you need an experienced team with significant industry experience combined with access to developing consumer insight based on what your patients believe.

You’ll find all of that, and more, with LAVIDGE.

In fact, healthcare marketing is a core category at LAVIDGE. We invest in primary research to keep abreast of consumer shifts in the healthcare industry.

For example, in 2016, we launched our first healthcare research study and published the results in 2017. We followed up by publishing an entire content suite of healthcare-related advice on how to apply the information to a host of marketing and advertising capabilities from Public Relations to Programmatic to help industry players achieve their goals.

Our 2019-2020 study digs deeper and provides updates on what’s most important to healthcare consumers today.

Finally, because our strong roster of current and past clients represents a wide range of organizations in the health care category including Banner Health, Blue Cross Blue Shield, Delta Dental, SimonMed Imaging, Sonora Quest Laboratories, and TGen, it’s clear that LAVIDGE is an agency you can trust.

We’d love to show you what our research can do for you.

To learn more about our healthcare attitudinal research study, contact Dave Nobs.